Files You’ll need for a mortgage Pre-Acceptance into the Texas

You have made the choice to pick a home during the Tx and you’ve got read one providing financial support pre-acceptance is best situation for you to do before you actually start home query. It https://paydayloanflorida.net/south-brooksville/ is actually higher advice about a couple trick explanations.

Basic, you will understand the particular spending budget in your arrive at and so helping you save many frustration and you can day. And second, when you get pre-accepted, suppliers may take you surely and thus end up being significantly more prepared to get into genuine deals.

What files would you like to score home financing preapproval within the Georgia?

Prior to you heading out over the lending company, try to have specific data to own home financing pre-recognition when you look at the Texas.

step one. Evidence of Income and you may A position

You’ll obviously need certainly to inform you lenders that you’re not just functioning and also that your particular money is sufficient sufficient to possess you to definitely keep up with the mortgage payments per month.

The type of data you’ll need for mortgage pre-recognition into the Colorado depend on your own a position situation and additionally the way you try paid. Still, in any situation, you’ll likely have to provide copies of the earlier dos years’ taxation output, each other federal and state.

- Salary Earners therefore the Salaried: Duplicates of the past pair spend stubs and more than recent dos years’ W-2 versions together with info out of bonuses and you will overtime.

- Self-Working People (Freelancers and you will Separate Contractors): Profit-and-losings comments while the last couple of years’ Form 1099. This is sold with S-providers, partnerships, and you may just proprietorships.

For those who have people, additionally, you will have to render proof home money. In case it is a rental assets, you may be required to supply the property’s market value collectively that have proof of leasing income.

dos. Suggestions out of Property

A list of possessions is another of your own data files you will be asked to allow for home loan pre-acceptance from inside the Tx. Per savings account (coupons, examining, money market, an such like.) you’ll need copies with a minimum of sixty days’ property value statements.

Additionally, you want the latest statements for the past two months for all of your current financing levels for example Dvds, stocks and you will ties. It’s adviseable to anticipate to provide the most up to date quarterly declaration indicating brand new vested equilibrium when it comes down to 401(k)s.

step three. Selection of Monthly Financial obligation Payments

Loan providers will really need to know simply how much you have to pay away every month to pay for your financial situation. So, you happen to be expected to render formal records from month-to-month debt-commission obligations particularly student loans, almost every other mortgage loans, auto loans, and you will playing cards. Lenders will require that render for each creditor’s term and you can address, also the account balance, minimal payment, and you will financing balance.

While currently renting, you’ll likely be asked to offer lease-percentage invoices over the past 1 year. Be sure become ready to offer property manager contact details getting possibly the early in the day 2 years.

cuatro. Records of Other Expenditures and you can Monetary Incidents

Most other info that will be a portion of the data files necessary for mortgage pre-approval when you look at the Colorado are those used in documenting certain existence-event costs. Including, whenever you are separated, you need to be happy to promote judge orders getting youngster support and alimony money. For those who have stated bankruptcy proceeding otherwise undergone foreclosures, you’re needed to promote relevant data.

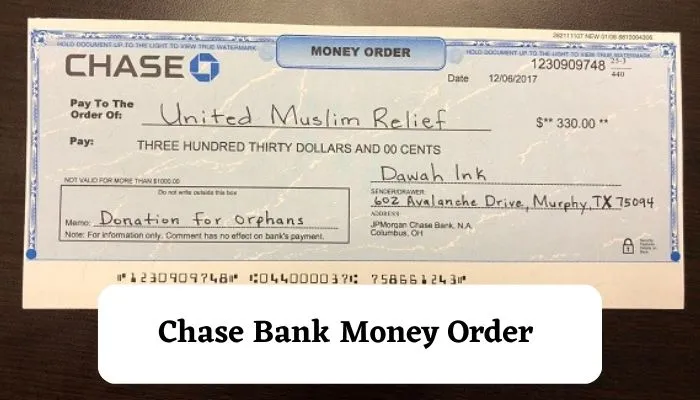

Here is one finally thought. Lenders can occasionally question you precisely how you want to cover the fresh deposit with the property. So, keep in mind that you will be needed to tell you proof of this new sourced elements of currency for the goal.

Are pre-accepted to have resource is based generally on files you give and once you have got over one to, you can embark on your house-hunting trip.

When you need to find out about an informed ways to score pre-acknowledged together with other funding selection, contact from the mobile phone during the or from the completing their short offer!